Azamara Cruise Insurance - 2025 Review

Azamara Cruise Insurance

6

Strengths

- Strong Insurance Partner

- Easy to add insurance at checkout

Weaknesses

- No Medical Waiver

- Weak Medical Insurance

- Weak Medical Evacuation

Sharing is caring!

Azamara Cruises for 2025

Azamara prides itself on its ability to set itself apart from many of the other cruise lines by offering unique, intimate experiences at each destination. Touting hidden gems and immersive locally inspired experiences, this cruise line is considered ideal for travelers who are seeking a more culturally transformative adventure. If the idea of a “boutique hotel at sea” is appealing to you for your next vacation, then you’ll want to reserve a room on board one of Azamara Cruise ships four ships.

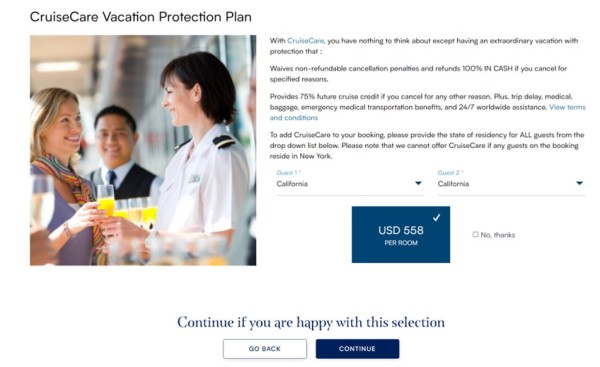

Of course, no adventure is complete without proper travel protection. Azamara’s travel insurance program, Azamara CruiseCare is underwritten by Arch Insurance Company. The Azamara CruiseCare plan provides what can only be described as basic coverages. As you make your way through the selections on the Azamara website, you are asked whether you would like to add this plan to your reservation.

Sample Cruise Itinerary

To be able to demonstrate the quality of coverage, price and benefit levels of the Azamara CruiseCare plan versus other plans available in the wider travel insurance marketplace, we need to take a vacation. So let's hoist the main-sail, order our sail-away cocktails and take a trip with Azamara.

To get an idea of Azamara’s travel insurance plan and cost we attempted to book our cruise. We chose the 10-day Greece Intensive Voyage, from August 10 - 19, 2022. For our quote our travelers are both aged 65. They reside in California and the total cost of the cruise for both travelers is $6,559.

Once we’ve selected our room through the Azamara site, we arrive at the travel insurance option page. The cost for this plan seems to be based on varying factors. If one were to select a different room or a different package, the price of the Azamara CruiseCare changes. It is not clear how pricing is structured. In our case, the cost of the Azamara CruiseCare insurance for our trip is $558 for both travelers.

When traveling outside the United States, our team at TripInsure101 recommend a minimum coverage of $100,000 in Medical Insurance, $250,000 in Medical Evacuation, and if at all possible we strongly advocate you select a plan that gives you a Pre-existing Medical Condition Waiver.

Turning to the Azamara CruiseCare, we can see that the policy provides the following basic travel insurance coverages:

- Trip Interruption: up to 150% of total trip cost

- Trip Delay: up to $500 for catch-up expenses

- Accident Medical: up to $25,000 if you get hurt on your vacation

- Sickness Medical: up to $25,000 if you get sick on your vacation

- Emergency Medical Evacuation: up to $50,000 if you need emergency medical transportation

- Baggage Protection: up to $1,500 if your bags are lost, stolen or damaged

- Baggage Delay: up to $500 to purchase necessary personal items if your bags are delayed

- Missed Connection: up to $300 for transportation expenses

Further on in this review we explain why we recommend much higher limits to those offered by the Azamara CruiseCare plan, and we provide an objective review of Azamara’s insurance cost for coverage by comparing it to some of the other independent travel insurance providers available to you.

Comparison Quotes

Based on our sample couple, both aged 65 years, we created comparison quotes using TripInsure101’s travel insurance marketplace engine. The trip cost used for the comparison is the cruise cost for both travelers, $3,279.50 per person, for a total of $6,559.

We used TripInsure101’s recommendation of a minimum coverage of $100,000 in Medical Insurance, $250,000 in Medical Evacuation, and a Pre-existing Medical Condition Waiver to choose the selected quotes. We beleive this is the minimum acceptable coverage for excursions outside the United States.

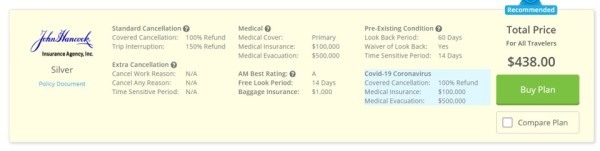

The least expensive plan with adequate coverage on our quote from TripInsure101 is the John Hancock Silver.

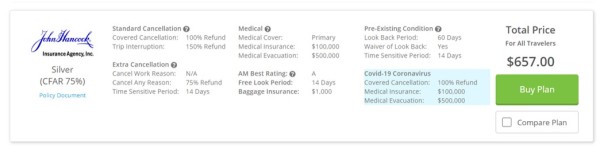

For a Cancel For Any Reason policy to provide greater cancellation flexibility, we chose the John Hancock Silver (CFAR 75%), because it is the least expensive plan which includes Cancel For Any Reason (CFAR) benefits, and would be comparable to the Azamara CruiseCare plan.

Next, we break down the benefits of each policy in a side-by-side comparison so you can see what coverage levels and price the three options give you.

|

Benefit |

Azamara CruiseCare Plan |

John Hancock Silver |

John Hancock Silver (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

150% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$25,000 |

$100,000 |

$100,000 |

|

Medical Evacuation |

$50,000 |

$500,000 |

$500,000 |

|

Baggage Loss/Damage |

$1,500 |

$250/article up to $1,000 per person |

$250/article up to $1,000 per person |

|

Baggage Delay |

$500 |

$500 |

$500 |

|

Travel Delay (Incl quarantine) |

$500 |

$750 per person |

$750 per person |

|

Missed Connection |

No |

$750 per person |

$750 per person |

|

Cover Pre-existing Medical Conditions |

No |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 14 days of deposit |

|

Cancel For Work Reason |

No |

No |

No |

|

Interrupt For Any Reason |

No |

No |

No |

|

Cancel For Any Reason

|

90% cancellation fees as future cruise credit |

No |

75% of trip cost |

|

Accidental Death & Dismemberment |

No |

Optional add-on up to $500,000 |

Optional add-on up to $500,000 |

|

Cost of Policy |

$558 (8.51% of trip cost) |

$438 (6.68% of trip cost) |

$657 (10% of trip cost) |

Cost Comparison

Overall, it is clear to see that the Azamara CruiseCare has minimal coverage. Their Protection Plan Plus (CFAR) policy does not increase coverage from their standard policy and only provides a cruise credit valid for one year if using the CFAR option. Both TripInsure101 policies provide 4x the medical coverage and 10x the medical evacuation coverage over the Azamara CruiseCare policy.

By shopping for cruise insurance through TripInsure101, our two travelers can save over $100 for a standard cancellation plan, which can be applied to airfare, additional tours, or shopping. Or, for only about $50 more per person, they can secure this same great coverage plus a cancel for any reason benefit which would give them a 75% cash refund if canceling for a reason not listed in the policy.

In the following sections, we explain why we make certain recommendations and what we suggest you look for when shopping for travel insurance for your Azamara cruise.

Trip Cancellation

A significant concern for travelers is Trip Cancellation. If you became ill or had an accidental injury prior to your departure date, you may have to cancel your travel arrangements, resulting in financial losses. While this would of course be disappointing, Trip Cancellation is doubly painful without cancellation insurance.

Azamara’s CruiseCare Plan permits cancellation for the following reasons:

- Sickness, injury, or death of yourself, a traveling companion, or members of either of your immediate families, which is diagnosed and treated by a physician at the time your cruise vacation is terminated

- Involvement in a traffic accident, en route to departure, that causes you to miss your cruise

- Your home is made uninhabitable by a natural disaster such as fire, flood, earthquake, hurricane, or volcano

- You are called into active duty by the military to provide aid or relief as a result of a natural disaster

- Subpoena or being called to serve for Jury duty

The above list is indeed valuable coverage; however, at TripInsure101, recommend policies that also include:

- Quarantine

- Inclement weather

- Involuntary Termination (layoff)

- Terrorism

- Strikes

- Default or bankruptcy of the common carrier or travel supplier

- Employer-initiated transfer of 250 miles or more

- Destination uninhabitable or unreachable by fire, flood or natural disaster

- Mechanical breakdown of a common carrier

- Hurricanes

- Documented theft of passports or visas.

The John Hancock Silver plan offers a far broader list of covered reasons, including cancelling due to contracting COVID.

Trip Interruption

A Trip Interruption is a situation during your trip that causes you to miss some or the rest of your vacation. It’s like Trip Cancellation but happens during your travels.

The most common trip interruption is the injury or illness of a traveler. If you had an injury or illness on your vacation but can continue traveling after treatment, trip interruption reimburses the unused portion of the trip, and the cost to rejoin the trip in progress.

Trip interruption also includes a family member who had a sudden grave illness or passed away. If your covered situation requires curtailing the trip and going home early, Trip Interruption also reimburses for the unused portion of the trip, plus the added cost of going home early.

In the Azamara CruiseCare insurance policy, Trip Interruption benefits share the same list of covered reasons as Trip Cancellation. Same goes for the John Hancock plan—the broad list of covered reasons for Trip Cancellation also applies to Trip Interruption. Both the Azamara CruiseCare plan and the John Hancock plan offer 150% of trip costs for interruption. Therefore, they cover up to 100% of the unused costs, plus up to an additional 50% to cover transportation costs to return home. This is a useful coverage as return flights on the day you need them are likely to be far more expensive than booking onths in advance.

Cancel For Any Reason

Cancel For Any Reason cruise insurance provides the highest level of flexibility and reimbursement if you must cancel your trip for any reason not covered by the policy.

If you cancel your Azamara cruise for a reason not listed in the CruiseCare policy, they grant future credits for 90% of the prepaid, non-refundable cancellation fees paid to them. Credits expire after one year, are non-transferrable and not redeemable for cash. Azamara, not their insurance policy, provides this Cancellation Penalty Waiver. When it comes to refunds, we always prefer cash since future credits may not be used.

Alternatively, travel insurance policies like John Hancock Silver with Cancel For Any Reason included pay a 75% cash refund of all prepaid, non-refundable trip costs including arrangements made outside of Azamara. This could include flights, hotels, rental cars, excursions, and transfers.

Cancel For Any Reason policies have several stipulations:

- Purchase the policy within 10 - 21 days (depending on policy), of your initial payment or deposit date and

- Insure 100% of the prepaid trip costs subject to cancellation penalties or restrictions. For additional prepaid non-refundable payments made after the purchase of the policy, insure within 10-21 days (depending on policy), of each subsequent payment added to your trip, and

- Cancel your trip 2 days or more before your scheduled departure date.

Medical Insurance for Emergency Treatment

One of the biggest concerns that most people have when travelling abroad is Medical Insurance. Anything can happen, including accidental injuries or sudden illness. Many Americans mistakenly believe countries with universal health care will treat them for free. Unfortunately, this is not the case.

Instead, Americans receive treatment at private hospitals, not public, and must pay like anyone else. Admission for inpatient care can cost $3,000-$4,000 per day, plus the cost of treatment, x-rays, surgeries, and specialists.

A common question we’re asked is, “Would my primary medical plan in the USA cover me internationally?” Most of the time, it would not. Even when there is international coverage, we find there are large deductibles to be met first. For example, while Medicare does not cover you overseas, some Medicare supplements do, but have lifetime limits or reduced benefits, and pay for emergencies only. They can still require you to pay a 20% coinsurance.

If you have a medical emergency when traveling and don’t have proper medical insurance coverage, you could find yourself with devastatingly large hospital bills.

TripInsure101 urges overseas travelers to take travel medical insurance of at least $100,000 per person. In a medical emergency, $100,000 provides ample health care and helps protect your retirement savings from unexpected financial burdens.

Azamara CruiseCare only provides a $25,000 benefit for Medical Insurance. John Hancock’s Silver policy includes $100,000 per person of Medical Insurance, so you can receive proper care and treatment without finding yourself in debt.

Emergency Medical Evacuation

Unfortunately, injuries and illnesses don’t always occur while you are near a hospital. An accident can happen on a ship, during a culturally immersive tour or in some other remote location. This is where Emergency Medical Evacuation becomes crucial. This coverage pays to transport you from the place of injury or illness to the closest hospital able to adequately treat your condition. Once you’re stable enough for transport, Medical Evacuation brings you home via commercial flight or, if necessary, private medical jet.

Medical flights can cost up to $25,000 per hour, and regular health insurance typically would not cover this cost. In addition, the US State Department does not offer any medical treatment or evacuation assistance for US citizens. TripInsure101 recommends that travelers hold at least $250,000 in Medical Evacuation to assure there’s enough coverage to bring you safely home from almost anywhere in the world. Note: When travelling to Asia, Africa or beyond, the team at TripInsure101 recommend you carry at least $500,000 of Medical Evacuation coverage.

Azamara’s CruiseCare plan includes Medical Evacuation, but only up to $50,000 per person. By contrast, the John Hancock Silver provides $500,000 per person for Medical Evacuation. That’s an extra zero on the end ($450,000 more coverage) for more than $100 less in premium! It certainly pays to shop around! Consider this extra money in your wallet to go out to dinner, buy souveniers, or see a show at one of the ports-of-call.

Pre-existing Medical Conditions

A significant concern, especially for senior travelers, can be pre-existing medical conditions. A Pre-Existing Medical Condition is one in which you’ve received medical treatment, testing, medication changes, added new medications, or received a recommendation for a treatment or test that hasn’t happened yet. Most travel insurance policies exclude pre-existing conditions unless you purchase the policy within the required time period from your initial trip deposit date (called the Time Sensitive Period). Otherwise, the insurer will look backward 60, 90, or 180 days (depending on the policy) from the date you purchased the insurance to see if there are any pre-existing medical conditions they won’t cover. This is called the Look Back Period. Any medical conditions older than this Look Back Period, unchanged or stabilized with no medication dosage changes are covered, as are any new conditions that arise after you purchase the policy.

If you must cancel, interrupt, or seek medical treatment for a medical condition while traveling, travel insurance policies typically exclude claims related to Pre-existing Medical Conditions. However, if you purchase the policy within a few days of your Initial Trip Payment or Deposit date, many policies add a Waiver to the policy that covers Pre-existing Conditions. As a result, there is no Look Back Period, and Pre-existing Conditions are covered.

Sadly, the Azamara CruiseCare policy does not cover any Pre-existing conditions. The John Hancock Silver policy, with and without CFAR, does cover Pre-existing Medical Conditions if the policy is purchased during the 14-day Time Sensitive Period.

Price and Value

In comparison to the John Hancock Silver and John Hancock Silver (CFAR 75%) policies we found on TripInsure101, the Azamara CruiseCare plan falls short in several areas. The CruiseCare plan provides minimal coverage and is more expensive than other available options. The medical insurance coverage is only $25,000, and medical evacuation is only $50,000, which may not be adequate for a serious illness or injury. Cancellation reasons are limited and adding the Cancel For Any Reason option only grants future cruise credits that expire after a year. Overall, the CruiseCare plan offers limited value for the price.

In contrast, by comparison shopping, we found the John Hancock policy comes in at $438 ($120 LESS than Azamara!) It includes superior medical and evacuation benefits, 100% refund for trip costs for covered cancellation, 150% refund for covered trip interruption, and a robust list of cancellation reasons. The John Hancock Silver also comes with the option to add a true, cash back CFAR option for a total policy premium of only about $100 more than the Azamara plan.

Conclusion

After extensive review of both policies, we’ve determined the Azamara CruiseCare plan, while featuring some important coverages, lacks many of the essential benefits we feel a travel policy should include at the limits we recommend. Unfortunately, medical coverage and medical evacuation limits are low, and there are a limited number of covered cancellation and interruption reasons. Overall, we rate it a 6 out of 10.

Travelers planning a culturally immersive Azamara Cruise will find the best value for their money and peace of mind when they shop around for travel insurance at TripInsure101 – the Travel Insurance Marketplace. There, you can review dozens of options, easily compare prices, and select the best policy to fit your needs.

Remember, TripInsure101 recommends having at least $100,000 in travel medical coverage and $250,000 emergency medical evacuation when traveling outside the US ($500,000 if travelling to Asia or Africa). And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with the Pre-existing Condition Waiver included to ensure the most coverage for your money.

If you are planning an Azamara cruise in 2022, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at agent@TripInsure101.com or alternatively call us at +1(650) 397-6592. We would love to hear from you.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

clancygirl

Thank you very much! …

The person I spoke with was very nice and helpful. I was very happy to discover the my trip insurance was going to cost less than I expected. Thank you!

customer

Quick easy and met my financial goal

Quick easy and met my financial goal

Carol

Quick, easy and economical

Melanie was very knowlegeable about all the policies and very helpful in finding the right policy for use. We are extremely happy with the results. She mad the process so easy and easy to understand. We will do business with you the next time we need travel insurance. Thank you.