Celebrity Cruises Travel Insurance - 2025 Review

Celebrity Cruises Travel Insurance

7

Strengths

- Strong Insurance Partner

Weaknesses

- Expensive

- Weak Cover

Sharing is caring!

Celebrity Cruises is considered by many to be one of the top cruising brands in the world. Over the years their desire for excellence in all levels of customer service has helped propel them to a long list of awards over the years including the 2020 Travvy Award for Best Premium Cruise Line. Celebrity Cruise Lines aims to provide their customer with the best cruise vacation possible, whilst also working hard to sustain the environment and striving to leave the world a better place. Celebrity pride themselves on their luxurious accommodations which invites you to “revel in stylish design.” Onboard experiences include world-class entertainment, state-of-the-art fitness and wellness centers, casinos, and so more. As with many other cruise lines in this day and age, Celebrity have also partnered a number of with renowned wolrd-class chefs which has helped earn them the 2020 WAVE Award for Best Onboard Dinning.

With over 300 destinations across all seven continents, Celebrity strive to offer something for everyone.

Sample Cruise Itinerary

In this review we consider the travel insurance protection offered by Celebrity when booking, and then compare it against other plans available in the wider marketplace. To do this, we need to go on a Celebrity cruise, so let's haul up the anchor and set sail.

For our example, we chose an 8-day cruise that departs from Athens, Greece, and travels to Italy and Spain before returning back to Athens. We selected cruise dates of 10/03/2022 – 10/10/2022. For our travelers, they are two adults who are aged 55 and 60 and the cruise price per person is $3,609 which gives us a total of $7,218.

As airfares are purchased separately and pricing can vary massively for this part, we have not considered the airfare within the pricing for the amount to be insured, however you will of course want to insure your airfare in your trip insurance.

Comparison Quotes

Celebrity Cruises offers it's CruiseCare Travel Protection as an add-on to your cruise booking. It contains both insurance and non-insurance benefits. Their current program is administered by Aon Affinity, with some of the coverages being underwritten by Arch Insurance Company. Whilst Arch is certainly a strong insurance partner, the overall CruiseCare Program is not, in our opinion, a strong travel insurance plan due to low coverage limits.

Based on our sample couple, ages 55 and 60, we created comparison quotes using TripInsure101’s travel insurance marketplace engine. For the comparison we used the trip cost as the cruise cost for both travelers, namely $3,609 per person for a total of $7,218.

When traveling outside the United States, we recommend to our customers that they should have a minimum of $100,000 in Medical Insurance cover, a minimum of $250,000 in Medical Evacuation cover, and whenever possible to purchase a plan that gives them a Pre-existing Medical Condition Waiver. These are the criteria we used to choose the selected quotes.

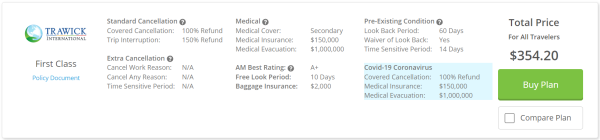

The least expensive plan with adequate coverage on our quote from TripInsure101 is the Trawick First Class. We will compare this plan to the CruiseCare plan that Celebrity currently offers.

This Trawick policy allows for cancellation for the most common reasons such as: unforeseen illness, accidental injury, or death of a family member. This is also the case with Celebrity’s CruiseCare plan. However, some travelers may also want the ability to cancel for any reason whatsoever, without then forfeiting their entire vacation investment. This is where a Cancel For Any Reason (CFAR) policy will allow the insured traveler to cancel for any reason not listed in the policy and still receive something in return. Trawick’s CFAR offers a 75% cash refund, whilst Celebrity’s CruiseCare CFAR offers a 90% refund, which is impressive, but this 90% refund is only in the form of future cruise credits. Not cash. It’s also important to point out that Trawick allows you to insure all the pre-paid, non-refundable expenses (which can include airfare, tours and excursions, etc). The Celebrity CruiseCare plan will only cover the cruise portion of your travels. This means that if you want to insure your flgihts as well (which you will), then you will need to buy a travel insurance plan in any event.

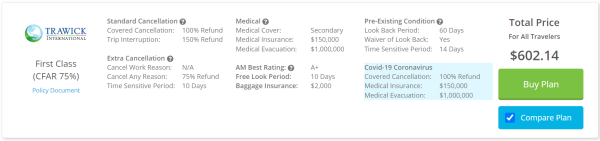

The Cancel For Any Reason (CFAR) policy that we chose for our comparison is the Trawick First Class (CFAR 75%). We chose this plan because it is the most affordable CFAR policy available that also meets the medical coverage limits that we recommend. In our example we compare this plan to the Celebrity CruiseCare Protection Plan (with CFAR).

Next, we break down the benefits of each policy in a side-by-side comparison so you can see the strenghts and weaknesses of each plan, and the price for each plan.

|

Benefit |

Celebrity CruiseCare Protection Plan |

Celebrity CruiseCare Protection Plan (with CFAR) |

Trawick First Class |

Trawick First Class (CFAR 75%) |

|

Trip Cancellation |

100% of cruise cost |

100% of cruise cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

150% of cruise cost |

150% of cruise cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$25,000 |

$25,000 |

$150,000 |

$150,000 |

|

Medical Evacuation |

$50,000 |

$50,000 |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$1,500 |

$1,500 |

$500/article up to $2,000 per person |

$500/article up to $2,000 per person |

|

Baggage Delay |

$500 |

$500 |

$400 |

$400 |

|

Travel Delay (Incl quarantine) |

$500 |

$500 |

$1000 per person |

$1000 per person |

|

Missed Connection |

$300 |

$300 |

$1,000 per person |

$1,000 per person |

|

Cover Pre-existing Medical Conditions |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 14 days of deposit |

|

Cancel For Work Reason |

No |

No |

No |

No |

|

Interrupt For Any Reason |

No |

No |

No |

No |

|

Cancel For Any Reason |

No |

90% of cruise cost (cruise credit only) |

No |

75% of trip cost |

|

Accidental Death & Dismemberment |

No |

No |

$25,000 |

$25,000 |

|

Cost of Policy |

$485.00 (6.72% of trip cost) |

$805.00 (11.15% of trip cost) |

$354.20 (4.91% of trip cost) |

$602.14 (8.34% or trip cost) |

Cost Comparison

In our opinion, overall Celebrity’s CruiseCare Travel Protection plans are insufficient. They provide only a fraction of the recommended limits of $100,000 in Medical Insurance, and $250,000 in Medical Emergency Evacuation cover. Also, something which is very important to many cruise travelers who have a medical condition, Celebrity Cruises does not offer a Pre-existing Medical Condition Waiver, which would waive their 60-day Look Back Period contained under their plans. Furthermore, whilst the CFAR policy provides a high percentage return, it only provides it as a cruise credit which is then only valid for one year instead of a cash refund option. A cruise credit is fine if you want to travel again with Celebrity and can medically do so within a year, but if not, you lose your entire holiday investment. Finally, as mentioned above, it’s also important to consider that Celebrity’s plans will only insure the cruise portion of your trip, not your flights or any other pre-paid expenses. If you have the need to cancel your trip and haven't got additonal travel protection in place, you are likely to lose your flight cost and any other non-refundable expenses you have paid.

By shopping for cruise insurance through TripInsure101, our two travelers can save anywhere from $130.80 to $202.86, which could be applied to airfare, additional tours, or shopping as well as gaining superior protection and a cash refund CFAR benefit.

In the following sections, we discuss what to look for when shopping for travel insurance for your Celebrity cruise.

Trip Cancellation

A significant concern for travelers is Trip Cancellation. If you become ill or have an accidental injury before your departure date, you may need to cancel your vacation, resulting in financial losses. This makes Trip Cancellation a very valuable feature if you’re keen to protect your vacation's financial investment.

The trip cancellation offered in the Celebrity Cruise insurance is a non-insurance benefit, which means that Celebrity Cruises offers the coverage and pays any claims, not an insurance provider. Their plans permit cancellation for the following reasons:

- Unexpected injury, illness, or death of traveler or family member.

- Residence uninhabitable by natural disaster, fire, flood, burglary

Unfortunately, Celebrity’s list of cancellation reasons lacks some of the most important coverages we would typically expect to see in a comprehensive travel insurance plan. We recommend policies that also include:

- Default or bankruptcy of the common carrier or travel supplier

- Cancel For Work Reason (traveler required to work during the trip)

- Employer-initiated transfer of 250 miles or more

- Destination uninhabitable or unreachable by fire, flood or natural disaster

- Mechanical breakdown of a common carrier

- Traveler involved in accident en-route to departure

- Mandatory evacuation

- Hurricanes

- Documented theft of passports or visas

- Jury duty, or subpoena.

Celebrity CruiseCare Travel Protection will provide a full refund if you have to cancel for a covered reason, but their Cancel For Any Reason policy only provides a 90% refund in the form of a future cruise credit, not a cash refund. Also, their protection plans do not cover any travel arrangements booked outside of your cruise, such as flights and transfers.

Both the Trawick First Class policy and the Trawick First Class (CFAR 75%) policy can cover all of your travel arrangements, regardless of where you booked them. Additionally, they both offer a 100% refund for covered Trip Cancellations, a 150% refund for covered Trip Interruptions (more on this below), and a wide list of covered reasons, including if you need to cancel due to contracting COVID.

Trip Interruption

A Trip Interruption is a situation during your trip that causes you to miss some or the rest of your vacation. Trip Interruption cover is similar to Trip Cancellation, but when an event occurs during your trip.

The most common trip interruption events are an injury or illness of a traveler. If you are unfortunate to have an injury or illness on your vacation but you can continue traveling after some treatment, the trip interruption benefit in the travel insurance reimburses the unused portion of your trip, and also covers the cost for you to rejoin the trip in progress.

Trip interruption also includes cover if a family member has a sudden grave illness or has sadly passed away. If your covered situation requires that your end your trip early to return home, Trip Interruption also reimburses for the unused portion of the trip, plus the added cost of going home early.

In the Celebrity CruiseCare Travel Protection insurance policy, Trip Interruption benefits include up to 150% of the total trip costs if you need to interrupt due to a covered reason. That amount includes reimbursement of unused trip costs plus the added cost of transportation home.

Travel insurance plans like the Trawick First Class also offer 150% of trip costs for interruption. Therefore, they cover up to 100% of the unused costs, plus up to an additional 50% to cover transportation costs to return home.

Cancel For Any Reason

Cancel For Any Reason cruise insurance gives a cruise traveler the highest level of flexibility and refund if they need to cancel their trip for any reason that is not covered in the policy schedule.

If you cancel your Celebrity cruise for a reason not listed in their policy, they will grant you future cruise credits for 90% of the prepaid, non-refundable cancellation fees paid to them. However, cruise credits expire after one year and they are non-transferrable and not redeemable for cash. Remember it is Celebrity, and not their insurance policy, that provides this part of the CruiseCare Travel Protection. Whilst a 90% CFAR cruise credit is attractive, it is only useful if you can use it. When it comes to refunds, we always prefer cash since future credits may not be used and will then expire. Cash doesn't have an expiration date!

Alternatively, travel insurance policies like Trawick First Class with Cancel For Any Reason included pays out 75% as a cash refund of all prepaid, non-refundable trip costs, including any arrangements made outside of Celebrity Cruises. This could include flights, hotels, rental cars, excursions, and transfers.

As you would expect there are a number of stipulations for a Cancel For Any Reason policy to pay out, but these are quite straightforward:

- Purchase the policy within 10 to 21 days (depending on policy bought), of your initial payment or deposit date,

- Insure 100% of the prepaid trip costs subject to cancellation penalties or restrictions. If you have yet to book your entire trip, buy your travel insurance for what has already been booked, within 10-21 days (depending on policy), and add to it as you book additional parts of your trip,

- Cancel your trip 2 days or more before your scheduled departure date.

Medical Insurance for Emergency Treatment

One of the most important factors in selecting trip insurance is having sufficient Medical Insurance when you travel. Anything can happen at anytime, often when we least expect it, be it accidental injuries or a sudden illness.

If you have a medical emergency when traveling and you don’t have sufficient medical insurance coverage when overseas, you may find yourself with huge, unexpected hospital bills to pay out of your own pocket. Many Americans mistakenly believe that countries which have universal health care for their own citizens will treat them for free if they have a medical emergency. Unfortunately, this is not the case.

Instead, Americans receive treatment at private hospitals, not public ones, and they must pay like anyone else does. Admission for inpatient care can cost $3,000-$4,000 per day in a private hospital, and then you need to factor in the additional costs of treatment, x-rays, surgeries, and specialists.

A common misconception is that Medicare will pay for hospitalization overseas. Unfortunately, it won’t. Medicare does not pay for medical providers outside the US. Some Medicare supplements plans do cover overseas, but these have a small lifetime limit or reduced benefits, and will pay for emergencies only. They can also still require you to pay 20% of the costs. As a result, you could go on your dream vacation and end up with medical bills in the thousands.

TripInsure101 urges overseas travelers to take travel medical insurance of at least $100,000 per person. In our opinion, in a medical emergency, $100,000 would provide ample health care and will help protect your retirement savings from a potentially massive unexpected financial burden.

Celebrity CruiseCare Travel Protection provides a $25,000 benefit for Medical Insurance that would cover illness or injury. Compared to Trawick’s First Class policy which includes $150,000 of medical coverage per person, you can immediately see that the Trawick plan is much better suited to ensure you receive proper treatment without ending up in debt.

Emergency Medical Evacuation

Medical Insurance isn’t the only potentially expensive part of a trip. Emergency Medical Evacuation transports you from the place of injury or illness to the closest hospital. Once you’re stable enough for transport, Medical Evacuation brings you home via commercial flight or, if necessary, private medical jet.

Medical evacuation flights can be very expensive and cost up to $25,000 per hour of flight time. Regular health insurance does not cover this. In addition, the US State Department does not offer any medical treatment or evacuation assistance for US citizens. TripInsure101 advises travelers to carry at least $250,000 of Medical Evacuation cover to assure there’s enough coverage to get them back home from almost anywhere in the world if they were to experience a serious medical event.

Celebrity CruiseCare Travel Protection includes Medical Evacuation up to $50,000 per person. By contrast the Trawick First Class plans both provide $1,000,000 per person for Medical Evacuation. Whilst $50,000 may initially sound like quite a lot of cover, when one takes into account the sort of costs possible with emergency evacuation, and the substantially greater levels of cover available with a full comprehensive travel insurance plan, the Celebrity CruiseCare Travel Protection plan starts to look somewhat lacking in substance if the worst were to happen.

Pre-existing Medical Conditions

A significant concern for senior travelers can be pre-existing medical conditions. A Pre-Existing Medical Condition is one in which you’ve received medical treatment, testing, medication changes, added new medications, or received a recommendation for a treatment or test that hasn’t happened yet. Most travel insurance policies exclude pre-existing conditions unless you purchase the policy within the required time-period from your initial trip deposit date (called the Time Sensitive Period). Otherwise, the insurer will look backward 60, 90, or even 180 days (depending on the policy) from the date you purchased the insurance to see if there are any pre-existing medical conditions they won’t cover. This is called the Look Back Period. Any medical conditions older than this Look Back Period, unchanged or stabilized with no medication dosage changes are covered, as are any new conditions that arise after you purchase the policy.

If you must cancel, interrupt, or seek medical treatment for a medical condition while traveling, travel insurance policies typically exclude claims related to Pre-existing Medical Conditions. However, if you purchase the policy within a few days of your Initial Trip Payment or Deposit date, many policies add a Waiver to the policy that covers Pre-existing Conditions. As a result, there is no Look Back Period and Pre-existing Conditions are covered. What's more, most of the plans on TripInsure101 that offer a pre-existing condition waiver offer it at no additional cost. All you need to do is buy the plan within the time senstive period to get the added protection.

The CruiseCare Travel Protection covers Pre-Existing Conditions provided that:

- Your payment for this plan is received within the Time Sensitive Period (14 days of Initial Trip Payment) and

- You insure 100% of the cost of all Travel Arrangements that are subject to cancellation penalties and

- You or the individual with the Pre-Existing Condition, are not disabled from travel at the time You make Your payment for this plan, and

- Trip cost per person does not exceed $15,000 per person

The Trawick First Class policies also cover Pre-existing Medical Conditions, and the same 14-day Time Sensitive Period applies. Additionally, the Trawick policy does not have a cap on the trip cost.

Price and Value

In our opinion Celebrity’s CruiseCare Travel Protection plans carry minimal coverage and are more expensive than other options available on the wider travel insurance marketplace. The medical insurance cover is only $25,000, while the medical evacuation cover is only $50,000, which we feel may not be adequate for a serious illness or injury. Turning to their Cancellation reasons we feel these are rather limited and adding the Cancel For Any Reason option substantially increases the cost of the insurance yet only grants future cruise credits that will expire after just one year. Overall, we believe it offers limited value for the price charged.

In contrast, by comparison shopping, we found the standard Trawick First Class policy comes in at $354.20. It includes far superior medical and evacuation benefits, a 100% refund for trip costs for covered cancellation, a 150% refund for covered trip interruption, and a very robust list of cancellation reasons.

Choosing the CruiseCare Travel Protection plan with Cancel For Any Reason didn’t provide any better value. Their Cancel For Any Reason option will certainly provide a 90% cover, but only as a future cruise credit for up to one year, not a cash refund. Again, by comparison shopping, we found the Trawick First Class (CFAR 75%) policy for $602.14. It includes $150,000 of medical insurance and a substanial $1,000,000 for medical evacuation. Plus, it includes a Cancel For Any Reason provision that refunds 75% of your trip costs back in cash, not future cruise credit. It has far superior coverage levels over Celebrity’s policy at a more affordable rate.

Conclusion

Celebrity’s CruiseCare Travel Protection plans provides travelers with a minimal insurance policy for a high cost that could leave travelers unpleasantly surprised if they were to have an emergency. Medical coverage and medical evacuation limits are worryingly low, and there are a limited number of covered cancellation and interruption reasons, as well as insufficient trip cost reimbursement. Overall, we rate it a 7 out of 10.

Travelers planning a Celebrity vacation will find the best value for their money and peace of mind when they shop for travel insurance at TripInsure101 Travel Insurance Marketplace. There, you can review dozens of options and select the best policy to fit your needs.

To help you find the best policy, TripInsure101 recommends having at least $100,000 in travel medical coverage and $250,000 emergency medical evacuation when traveling within 2 to 3 hours of the US. If traveling further afield we recommend $500,000 of emergency evacuation cover. And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with includes a pre-existing condition waiver to ensure that you get the most coverage for your money.

If you are planning a Celebrity cruise in 2022 or beyond, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at agent@TripInsure101.com or alternatively call us at +1(650) 397-6592. We would love to hear from you.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

clancygirl

Thank you very much! …

The person I spoke with was very nice and helpful. I was very happy to discover the my trip insurance was going to cost less than I expected. Thank you!

customer

Quick easy and met my financial goal

Quick easy and met my financial goal

Carol

Quick, easy and economical

Melanie was very knowlegeable about all the policies and very helpful in finding the right policy for use. We are extremely happy with the results. She mad the process so easy and easy to understand. We will do business with you the next time we need travel insurance. Thank you.