Costa Carefree Travel Insurance - 2025 Review

Costa Carefree Travel Insurance

6

Strengths

- Strong Insurance Partner

Weaknesses

- High Cost

- Weak Medical Benefits

- Weak Evacuation Benefits

- No Coverage for Pre-existing Medical Conditions

Sharing is caring!

Costa Cruises Carefree Travel Insurance

With cruises to the Mediterranean, Europe, the Baltic Sea, the Caribbean, Central America, South America, and more, Costa Cruises has been introducing their guests to some of the world’s most stunning destinations for 70 years. Costa also offers pre-paid land excursions, including zip lining, sand dune adventures, and glacier walks. Costa are owned by the Carnival Corporation.

Costa Cruises’ own brand of travel insurance is called “Carefree Travel Protection.” It’s a policy which is underwritten by Nationwide, and administered by Aon Affinity. The plan has been made specifically for Costa Cruises. Both Nationwide and Aon Affinity are highly reputable insurance partners.

In our experience at TripInsure101, we have seen time and time again that travel insurance policies made specifically for the cruise or tour company typically lack sufficient emergency medical benefits that we would normally see in a comprehensive travel plan, and they often have gaps of coverage. They are also routinely excessively priced versus other plans available in the wider travel insurance marketplace.

Sadly, Costa’s Carefree Travel Protection holds true to form with highly restrictive cancellation reasons, lack of coverage for Pre-Existing Medical Conditions, and very weak medical benefits. All-in-all this is a travel insurance plan that we feel is best avoided.

Costa Cruises’ Cancellation Policy

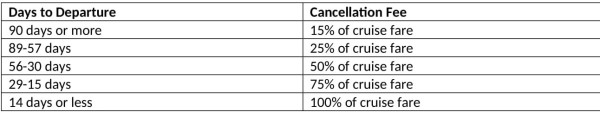

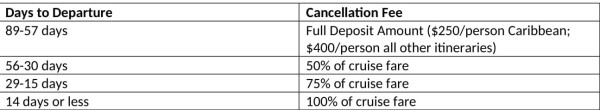

If you choose not to buy the Costa Cruises Travel Protection, you will be subject to their cancellation policy. Bear with us here as Costa make this rather confusing...

To understand the Costa cancellation policy, Costa Cruises offers guests the option to choose a “Comfort level” for their cruise, which is actually a complex system of upsells: Basic, Classic, Premium and Deluxe.

Although we have seen other cruise lines upsell drink packages, onboard credit, or even pre-paid tips at checkout, we have never seen a cruise line use a cancellation policy based on the upsold packages. Typically, cancellation tiers are based on the duration or destination of the cruise. So let's look into this for you and try and make things clearer.

As you might expect, the Basic level has the most restrictive cancellation policy, while the Classic, Premium and Deluxe levels are a bit more forgiving.

The table below shows the cancellation fees at the Basic level:

Next, the cancellation fees at the Classic, Premium, or Deluxe levels:

In short, the Basic level charges a minimum of 15% cancellation fee until 90 days prior to departure, then it goes up to 100% from there. The other levels keep the deposit as a cancellation fee until 56 days prior to departure, then they too increase to 100% fee over time.

What Does Costa Cruises Cover?

Costa Cruises Carefree Travel Protection covers all your travel arrangements (cruise fare, airfare, excursions, transfers, and hotels) booked through Costa Cruises.

Please note that if you make independent travel arrangements, such as through a travel aggregator website or directly with an airline or hotel, then Costa will not cover it. Therefore, if you cancelled your cruise, all money spent on private bookings would be entirely lost. This alone would require you to purchase a secondary travel insurance plan to cover your flights and other non-Costa purchased items. So why not simply see if you can get one single plan that covers your entire vacation expense, with more coverage and at a lower price.

Also note that not only would your additional trip costs not be covered by Costa, but any Medical Insurance or Medical Evacuation costs ahead of and after the cruise itself would also be missed. Unfortunately, this is a standard practice conducted by most travel insurance plans offered by cruise lines.

Our Costa Cruise

The best way for us to showcase the Csota plan versus other plans available in the travel insurance marketplace is by setting sale on our own Costa cruise and seeing what plans would be available for comparison purposes. So let's weight anchor, strike the main sail and search for a waiter with the cocktail of the day as we take to the high seas with Costa.

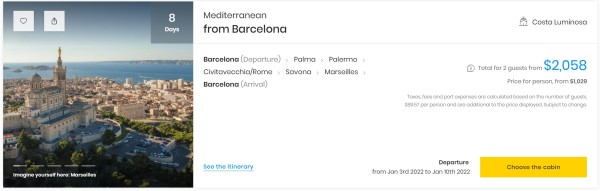

For our sample quote, we chose an 8-day Mediterranean cruise beginning in the beautiful port of Barcelona, with stops in Palma, Palermo, Rome, Savona, and Marseilles. Our sample couple, ages 55 and 60, will be cruising aboard the Costa Luminosa from January 3rd, 2022, to January 10th, 2022.

The total fare, after taxes and port fees, comes to $2,237.14. We chose the Basic Comfort level for the purpose of this review, which did not add to the cost.

When clicking through to make our deposit, there was no option to add travel protection. Upon calling Costa Cruises, we discovered the cost of the Carefree Travel Protection plan would be $159 per traveler, for a total of $318.

Is this a good deal? This article answers that question and provides alternative options to Costa’s Carefree Travel Protection.

Alternatives to Costa Cruises Carefree Travel Protection

Using the earlier example of a $2,237.14 trip, we plugged that data into the instant quote tool at TripInsure101 to find alternative travel insurance policies.

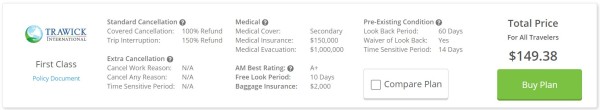

The least expensive plan that meets the minimum Medical Insurance and Medical Evacuation limits we recommend, including a Pre-Existing Medical Condition Exclusion Waiver, is the Trawick First Class, which costs $149.38 for both travelers.

As you can see, this plan includes $150,000 in Medical Insurance, $1,000,000 in Medical Evacuation coverage, and will cover Pre-Existing Conditions for free so long as the plan is purchased within the 14-day Time Sensitive Period. As an added bonus, the premium for this plan is less for both travelers than Costa’s Carefree Travel Protection costs for one.

For travelers looking for an added piece of mind, the least expensive Cancel For Any Reason (CFAR) plan would be the Trawick Voyager (CFAR 75%), at a cost of $250.86 for both travelers. This plan includes $250,000 in Medical Insurance, $1,000,000 in Medical Evacuation coverage, and will again cover for free Pre-Existing Conditions if the plan is purchased on the day of or before making your final scheduled payment towards the trip.

Both Trawick plans offer higher levels of coverage at a lower cost than the Carefree Travel Protection plan. Our two travelers would save $168.62 by purchasing the Trawick First Class, which could instead be used towards shopping or dining expenses on their trip. Even by selecting the higher priced Trawick Voyager (CFAR 75%), they would still save $67.14 over Costa’s plan.

The easiest way to see which plans offer what benefits and for what price is by using a side-by-side table to compare:

|

Benefit |

Costa Carefree Travel Protection |

Trawick First Class |

Trawick Voyager (CFAR 75%) |

|

Trip Cancellation |

Cash refund up to total cruise vacation cost, maximum limit of $50,000 |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

Cash refund up to total cruise vacation cost, maximum limit of $50,000 |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$10,000 per trip |

$150,000 per traveler |

$250,000 per traveler |

|

Medical Evacuation |

$30,000 per trip |

$1,000,000 per traveler |

$1,000,000 per traveler |

|

Baggage Loss/Damage |

$1,500 per trip |

$500/article, up to $2,000 per traveler |

$300/article up to $2,500 per traveler |

|

Baggage Delay |

$500 per trip |

$400 per traveler |

$600 per traveler |

|

Travel Delay (Incl quarantine) |

$1,000 per trip |

$1,000 per traveler |

$2,000 ($150/day) per traveler |

|

Missed Connection |

No |

$1,000 per traveler |

$1,000 per traveler |

|

Cover Pre-existing Medical Conditions |

No |

Yes, if purchased within 14 days of deposit |

Yes, if purchased on or before final payment |

|

Cancel For Work Reason |

No |

No |

No |

|

Interrupt For Any Reason |

No |

No |

No |

|

Cancel For Any Reason

|

No |

No |

75% of trip cost |

|

Accidental Death & Dismemberment |

No |

$10,000 (24 hour) |

$25,000 (24 hour) |

|

Cost of Policy |

$318 |

$149.38 |

$250.86 (11.2% of trip cost) |

Next, we’ll discuss these coverages in more detail.

Trip Cancellation

Trip Cancellation reimburses 100% of your total trip cost when you must cancel your trip for a covered reason. Trip costs can include airfare, cruise fare, accommodations, train tickets, tours, and excursions, so long as those costs are pre-paid and non-refundable.

Costa Carefree Travel Protection has a painfully short list of covered cancellation reasons:

- Your Sickness, Accidental Injury or death that results in medically imposed restrictions as certified by a Physician at the time of Loss preventing Your participation in the Trip. A Physician must advise to cancel the Trip on or before the Scheduled Departure Date;

- Sickness, Accidental Injury or death of a Family Member or Traveling Companion, booked to travel with You, that results in medically imposed restrictions as certified by a Physician preventing that person’s participation in the Trip;

- Sickness, Accidental Injury or death of a non-traveling Family Member;

- You or a Traveling Companion being hijacked, Quarantined, required to serve on a jury, subpoenaed;

- Having Your principal place of residence made Uninhabitable by fire, flood, volcano, earthquake, hurricane or other natural disaster;

- You or a Traveling Companion being directly involved in a traffic accident substantiated by a police report, while en route to departure;

- After one (1) year of continuous employment at the same company, You are terminated or laid-off, from full time employment by that company through no fault of Your own.

These reasons are basic and limiting for cancellation. Even the most basic policies offered through travel insurance marketplaces like TripInsure101 have at least 10 covered cancellation reasons.

There are a several cancellation reasons we noticed are not on this list, but appear on most of the policies available through TripInsure101, including the Trawick First Class and Trawick Voyager (CFAR 75%):

- Your residence or destination rendered uninhabitable due to natural disaster

- A terrorist incident in your destination within 30 days of departure

- Revocation of previously granted military leave

- Financial default of airline, cruise line or tour operator

- Strike causing cessation of services

- Inclement weather causing cessation of services

- A documented theft of passports or visas

Costa’s Carefree Travel Protection does not cover default of a common carrier or cruise line. So, if Costa Cruises went into bankruptcy, their travel insurance plan won’t even reimburse you for your financial loss.

And again, the Carefree Travel Protection plan only covers travel arrangements booked through Costa Cruises. There would be no coverage for independent travel arrangements booked elsewhere.

Alternatively, the plans offered at TripInsure101 would cover the cost of a Costa Cruise, along with any other independently made travel arrangements, such as airfare and accommodations prior to or after the cruise.

Cancel For Any Reason

What if the reason you’re concerned about having to cancel for is not covered? A Cancel for Any Reason policy would be a good choice in this situation.

If you need to cancel your trip for a reason not otherwise covered in the policy, Cancel For Any Reason (CFAR) allows you to cancel for that reason and still receive a reimbursement of your trip cost. However, the cost of this flexible privilege is that the refund is 50-75%, rather than 100%.

Unfortunately, Costa Cruises does not offer Cancel For Any Reason with their protection plan, meaning travelers who purchase their plan are limited to the few reasons they’ll cover for cancellation.

Meanwhile, several travel insurance plans available at TripInsure101 offer Cancel for Any Reason, including the Trawick Voyager (CFAR 75%), priced at $250.86 above.

However, there are some rules to follow when purchasing a Cancel For Any Reason plan:

- You must purchase the travel insurance within 10-21 days (depending on the policy) of the initial trip payment or deposit

- You must insure 100% of all pre-paid and nonrefundable trip costs

- You must cancel more than 2 days prior to the departure

- You will receive 50-75% (depending on the policy) refund of your trip costs

Trip Interruption

Trip Interruption reimburses the unused portion of your trip when your trip is interrupted for a covered reason. The covered reasons are the same covered reasons as Trip Cancellation. Trip Interruption also helps cover the cost for you to catch up to your trip, if you are able, or return home early.

For example, if you’re two days into your cruise and have a heart attack, this would be a Trip Interruption. You won’t be staying on the ship any longer because you’ll be moved to the hospital.

Costa Carefree pays a 100% refund for the unused pre-paid portion of your cruise if it’s interrupted. Although that sounds good, if the interruption is due to a pre-existing medical condition, there is no refund.

Medical Insurance

When traveling outside of the United States, Medical Insurance is one of the most critical parts of a travel insurance policy.

Many seniors are surprised to learn that Medicare does not provide coverage outside of the country. In addition, the US State Department will not provide any funds to cover medical care overseas. And while some Medicare Supplement plans do provide coverage outside of the US, they limit that coverage to a $50,000 lifetime maximum and require the insured to pay 20% of the bill.

Hospitals outside of the US might have great public health programs for their residents, but this coverage doesn’t extend to visitors. Instead, Americans must go to private hospitals and pay full price for treatment, often $3,000-4,000 per day.

As a result, TripInsure101 recommends travelers have at least $100k of Medical Insurance when leaving the country. This amount is enough to cover you as an inpatient, along with medical treatments and some surgeries if necessary.

The Costa Cruises Carefree Travel Protection plan does provide Medical Insurance, but at a feeble benefit of $10k, which is simply not enough to be properly covered for an emergency. Both the Trawick First Class and Trawick Voyager plans are much more suitable, with coverage of $150k and $250k, respectively.

Emergency Medical Evacuation

Emergency Medical Evacuation is another major segment of all travel insurance policies. This coverage transports you to the nearest facility that can adequately treat your illness or injury. If the physician treating you deems it necessary, the coverage then transports you back to the US for further treatment. Medical Evacuation coverage also returns a traveler’s remains home in the unlikely event they die on their trip.

The Costa Carefree Travel Protection plan pays a maximum of $30k for Medical Evacuation. This may sound like a lot, however, in a critical health event, your ride home might require a private medical jet with a team on board to oversee your care. This can cost between $15k-$25k per hour, meaning $30k in coverage would not nearly be enough.

TripInsure101 recommends at least $250,000 in Medical Evacuation coverage for US residents traveling outside the country. For travelers venturing to even further destinations away from home, such as Africa, Asia, or beyond, we recommend at least $500,000 in Medical Evacuation coverage.

That way, you can get home properly if you experience a worst-case scenario. $30,000 is a pitiful amount of coverage and could leave a traveler with incredibly high levels of co-payment in a worst-case scenario of a long-range private jet Medical Evacuation home.

Alternatively, both Trawick plans we reviewed contain $1,000,000 in Medical Evacuation coverage, which would ensure you’d be properly protected in a worst-case scenario.

Pre-Existing Medical Conditions

Travel insurance policies do not cover cancellation due to a Pre-Existing Medical Condition. It’s a standard, industry-wide exclusion, unless the policy has a Medical Waiver. We’ll discuss the Medical Waiver a bit later.

Pre-Existing Medical Conditions can affect whether a policy pays benefits for Trip Cancellation, Trip Interruption, Medical Insurance and Medical Evacuation. In other words, this is a very important element of any policy, so please investigate as every policy treats Pre-Existing Medical Conditions differently.

The Costa Cruises Travel Protection plan defines a Pre-Existing Medical Condition as:

An illness, disease, or other condition during the sixty (60) day period immediately prior to the Effective Date for which You, a Traveling Companion, a Family Member booked to travel with You:

1) exhibited symptoms that would have caused one to seek care or treatment; or

2) received or received a recommendation for a test, examination, or medical treatment; or

3) took or received a prescription for drugs or medicine.

Item (3) of this definition does not apply to a condition that is treated or controlled solely through the taking of prescription drugs or medicine and remains treated or controlled without any adjustment or change in the required prescription throughout the sixty (60) day period before the Effective Date

The Costa Cruises Carefree Travel Protection plan excludes coverage for Pre-Existing Medical Conditions; however, they do offer a future cruise credit equal to the cancellation fee. Per their website:

If your Trip Cancellation claim is denied due to a Pre-Existing Condition, Costa will provide you with a future travel credit equal to the cancellation fee amount. This non-insurance feature is provided by Costa.

In the travel insurance marketplace, most policies offer a Pre-Existing Medical Condition Exclusion Waiver, which modifies the policy to cover Pre-Existing Medical Conditions. That way, if you must cancel due to a Pre-Existing Medical Condition, you still receive 100% refund in cash.

TripInsure101 recommends travelers get a policy with a Pre-Existing Medical Condition Waiver whenever possible. Without it, there is an increased risk the insurance company could deny your claim. Medical Waivers are a Time Sensitive benefit, which means you must purchase a policy within 14-21 days (depending on the policy) of the date you place your initial payment or deposit towards the trip. It does not add to the cost of the policy, it is just a question of timing.

Trawick First Class will cover Pre-Existing Medical Conditions if the plan is purchased within 14 days of the initial trip payment or deposit date.

Trawick Voyager is unique, in that, the plan will provide coverage for Pre-Existing Medical Conditions if the plan is purchased on or before the day you make your final scheduled payment towards the trip. This is a great option for travelers who are looking for this coverage but are outside of the typical 14–21-day timeframe.

The two alternative plans to Costa Carefree shown above both include Pre-Existing Condition Waivers when these conditions are met:

- Your payment for this policy is received within the Time Sensitive Period

- You insure all pre-paid trip costs that are subject to cancellation penalties or restrictions, and also insure the cost of any subsequent travel arrangements (or any other travel arrangements not made through your travel agent) added to your trip within the Time Sensitive Period

- You are not disabled from travel at the time your premium is paid

Conclusion

It’s somewhat unfortunate and we feel rather misleading that Costa Cruises named its travel insurance policy “Carefree,” because it’s anything but carefree if you should need to use it.

In fact, cruisers, particularly seniors, who purchase the policy believing they’ll have proper cancellation protection and medical benefits would be in for a harsh reality if they had to make a claim.

Here’s why:

- Costa Medical Insurance and Medical Evacuation limits are incredibly low. It leaves the traveler open to a massive financial risk in the event of a medical emergency.

- Trip Cancellation and Trip Interruption coverages are extremely limited.

- Pre-Existing Medical Conditions are excluded with Costa. Should a traveler need to cancel for this reason, they’re only offered future credits in the amount of the cancellation fee.

- The plan does not even cover default of Costa itself - the cruise line. If Costa Cruises went into bankruptcy, neither their travel insurance plan nor the company itself would pay for a reimbursement.

All in all, it’s a traveler-unfriendly and restrictive policy with a premium price. Overall, we rate Costa’s Carefree plan a 6 out of 10. Better value will be found by shopping for a travel insurance policy through TripInsure101.

Will I Get a Better Deal Going Directly Through the Insurer?

No. Many don’t realize that they won’t find the same travel insurance plans available at a better price directly from the insurer. Prices are the same everywhere because of US anti-discriminatory laws.

Travelers can find the best plan to fit their travel needs by using a comparison site like ours to shop their options and find the appropriate coverage.

At TripInsure101, our knowledgeable licensed Client Managers will help you compare, contrast, and understand the coverages available in the plans we offer.

We guarantee you will not find a lower price for the plans on our site anywhere else, not even through the insurer directly.

Have questions? We would love to hear from you. Send us a chat, email TripInsure101, or call us at +1(650) 397-6592.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

clancygirl

Thank you very much! …

The person I spoke with was very nice and helpful. I was very happy to discover the my trip insurance was going to cost less than I expected. Thank you!

customer

Quick easy and met my financial goal

Quick easy and met my financial goal

Carol

Quick, easy and economical

Melanie was very knowlegeable about all the policies and very helpful in finding the right policy for use. We are extremely happy with the results. She mad the process so easy and easy to understand. We will do business with you the next time we need travel insurance. Thank you.