Island Windjammers Travel Insurance – 2025 Review

Island Windjammers Travel Insurance Review

8

Strengths

- Good Medical Evacuation limits

- Cancel For Work Reason included

Weaknesses

- No option for Cancel For Any Reason

- No Missed Connection benefit

Sharing is caring!

Background

Offering six and twelve-night sailings aboard their classic clipper ship Vela and schooner Diamant, Island Windjammers Vela hosts twenty-six guests, while the Diamant accommodates an intimate ten guests. Itineraries move at a relaxed pace and offer extended times in port to let travelers drink in the atmosphere of each port. Island Windjammers spend the winter and spring in the South Pacific, and summer and fall in the Caribbean.

As with many cruise lines, Island Windjammers offer their own travel protection plan to customers. In this review we will compare and contrast the plan offered by Island Windjammers against other plans available in the wider travel insurance marketplace. We will review price, coverage and benefit limits. So, to ensure our review is fair and accurate, we need to set sail with Island Windjammers and enjoy a relaxing cruise.

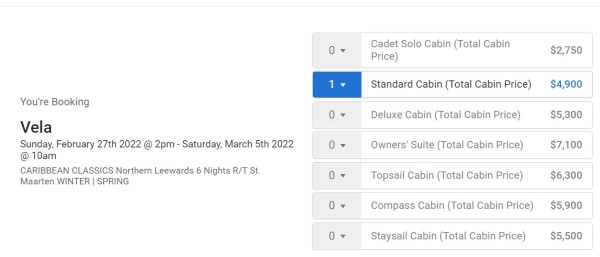

Our Sample Cruise: Caribbean Classics

Our sample couple, ages 55 and 60, selected the Caribbean Classics, a 6-night cruise through the Northern Leeward islands in the Caribbean from 2/27/2022 – 3/5/2022. We’ve added a day on either side to take air travel into account getting to St Maarten where the cruise embarks. After choosing our cabin, the total cost of the cruise is $4,900. As airline pricing can vary greatly, we’re only reviewing the actual cruise cost for this review. You will however wish to add all parts of your trip into your trip insurance plan, be it airline flights, hotels before and after your cruise and transfers.

How to Buy Travel Insurance with Island Windjammer Cruises’ Partner – TripMate

Island Windjammer partners with TripMate to provide travel insurance. They do not offer it themselves. Instead, you must go to the TripMate website. In 2019 TripMate was acquired by Generali Global, so the policies they provide are Generali policies.

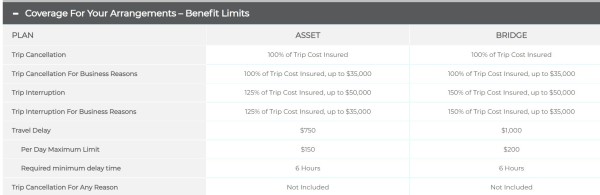

When looking at the insurance on TripMate, we have a choice of the Asset Plan or the Bridge Plan. Coverages for both are listed below:

Trip:

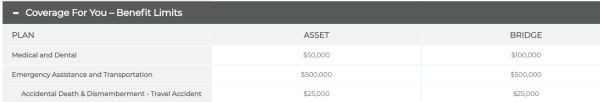

Medical:

Baggage:

The Asset Plan provides $50,000 for medical coverage per person which is half of what we recommend at TripInsure101. However, the Bridge Plan provides $100,000 medical coverage per person which is our minimum recommendation. Medical evacuation coverage for both plans is a generous $500,000, which is above our minimum recommendation of $250,000.

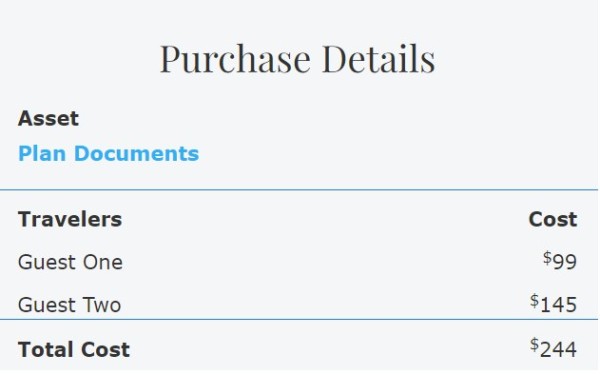

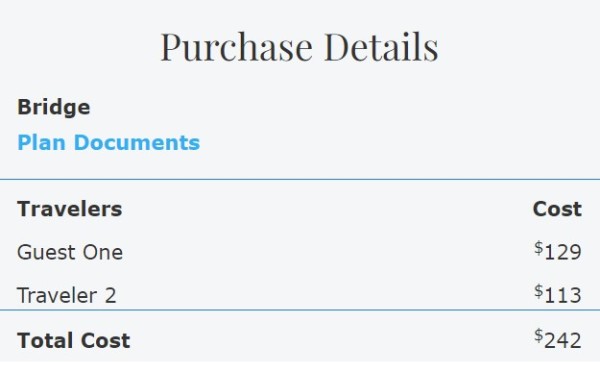

In terms of price, for our sample trip, choosing the Asset Plan would be $99 for our 55-year-old traveler and $145 for our 60-year-old traveler for a total of $244. The Bridge Plan would be $129 for our 55-year-old traveler and $113 for our 60-year-old traveler for a total of $242.

Comparison Quotes

To find out what other plans and prices are available in the travel insurance marketplace, we used the same sample details for our quote. Based on our sample couple, ages 55 and 60, we created comparison quotes using TripInsure101’s travel insurance marketplace engine to see if we could get better coverage than what TripMate’s plans offered. The trip cost used for the comparison is the cruise cost for both travelers is $4,900.

As mentioned previously, when traveling outside the United States, we recommend a minimum coverage of $100,000 in Medical Insurance, $250,000 in Medical Evacuation, and a Pre-existing Medical Condition Waiver. We used these criteria to choose the selected quotes.

The least expensive plan with adequate coverage on our quote from TripInsure101 is AIG Travel Guard Plus, at $251.22.

The AIG Travel Guard Plus provides $100,000 of medical coverage per person, $1 million of medical evacuation and coverage for pre-existing medical condition provided the policy is purchased within 21 days of the initial trip payment or deposit. It has 2x the medical and medical evacuation coverage than the Island Windjammer Asset Plan for only $7.22 more than the Windjammer Asset Plan. It has the same medical coverage as the Bridge Plan of $100,000 but has 2x the medical evacuation coverage than that policy for only $9.22 more than the Bridge Plan.

If we prefer a Cancel For Any Reason (CFAR) policy, the least expensive plan with adequate coverage would be the AIG Travel Guard Plus (CFAR 50%) at $307.30. This plan is comparable to the Island Windjammer Plan. The Trawick First Class (CFAR 75%) has the same coverage as the Trawick First Class but adds the Cancel For Any Reason option. Should you cancel for a reason NOT listed in the policy, you would be refunded 75% of the trip cost in cash, not cruise credits. When given the choice between cash or cruise credits, we prefer cash.

This plan has the same coverage as the AIG Travel Guard Plus plan but adds the Cancel For Any Reason option which the Island Windjammer policies do not provide. This allows you to cancel for ANY reason not listed in the policy and receive a 50% refund of non-refundable trip costs. It provides $100,000 of medical coverage per person, $1 million of medical evacuation and coverage for pre-existing medical condition provided the policy is purchased within 21 days of the initial trip payment or deposit. It has 2x the medical and medical evacuation coverage than the Island Windjammer Asset Plan for only $63.30 more than the Windjammer Asset Plan. It has the same medical coverage as the Bridge Plan of $100,000 but has 2x the medical evacuation coverage than that policy for only $65.30 more than the Bridge Plan.

We find the easiest way to see the differences between a number of plans is to present the benefit levels of each one and the prce in a side-by-side comparison table:

|

Benefit |

Island Windjammer Asset Plan |

Island Windjammer Bridge Plan |

AIG Travel Guard Plus |

AIG Travel Guard Plus (CFAR 50%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

125% of trip cost |

150% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$50,000 |

$100,000 |

$100,000 |

$100,000 |

|

Medical Evacuation |

$500,000 |

$500,000 |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$1,500 |

$2,000 |

$500/article up to $2,500 per person |

$500/article up to $2,500 per person |

|

Baggage Delay |

$250 |

$400 |

$400 |

400 |

|

Travel Delay (Incl quarantine) |

$750 ($150/day) |

$1000 ($200/day) |

$1000 per person |

$1000 per person |

|

Missed Connection |

$750 per person |

$750 per person |

$1,000 per person |

$500 per person |

|

Cover Pre-existing Medical Conditions |

Yes, if purchased within 15 days of deposit |

Yes, if purchased within 15 days of deposit |

Yes, if purchased within 21 days of deposit |

Yes, if purchased within 21 days of deposit |

|

Cancel For Work Reason |

Yes |

Yes |

Yes |

Yes |

|

Interrupt For Any Reason |

No |

No |

No |

No |

|

Cancel For Any Reason

|

No |

No |

No |

50% of trip cost in cash |

|

Accidental Death & Dismemberment |

$25,000 |

$25,000 |

$50,000 |

$50,000 |

|

Cost of Policy |

$244 (4.9% of trip cost) |

$242 (4.9% of trip cost) |

$251.22 (5.1% of trip cost) |

$307.30 (6.3% or trip cost) |

Cost Comparison

Overall, both the Island Windjammer Asset and Bridge policies provide decent coverage for a reasonable price. This is good to see and is not the norm for cruise line branded travel plans which we often see offering minimal coverage for a high price.

The Asset Plan’s medical coverage is lower than we’d recommend but the medical evacuation coverage on the policy is very good. The Bridge plan has excellent medical and medical evacuation coverage for a reasonable price. All in all we are very impressed with both plans, however, for extra flexibility should you need to cancel your trip for a reason that is not within the policy documentation, we would have liked to see a Cancel For Any Reason option available on one of the policies.

By shopping for cruise insurance through TripInsure101 our two travelers can have 2x times the medical coverage and medical evacuation coverage over the Asset plan and 2x the medical evacuation coverage over the Bridge Plan. Plus, if they choose a policy with a Cancel For Any Reason benefit, they can receive cash back if they choose to cancel for a reason not specified in the policy.

Also be aware that insurance offered by a cruise line only normally covers the cost of the cruise itself, not any associated costs such as flights to the departure port, hotels at the start or end of your cruise or transfers. If you also wanted to protect these elements of your trip, which you should, you would need to buy another plan in any event. Why not simply buy one plan that covers your entire trip expense, for similar money but with enhanced medical cover and with the option to include Cancel For Any Reason benefits.

In the following sections, we discuss know what to look for when shopping for travel insurance for your Island Windjammers cruise.

Trip Cancellation

A significant concern for travelers is Trip Cancellation. If you became ill or had an accidental injury prior to your departure date, you may have to cancel your travel arrangements, resulting in financial losses. While disappointing, Trip Cancellation is doubly painful without cancellation insurance.

The Island Windjammer Plans provide a wide range of cancellation reasons listed below, which are similar to the reasons listed in policies available at TripInsure101:

- Unexpected injury, illness, or death of traveler or non-traveling family member

- Involvement of a traffic accident that causes you to miss your cruise

- Residence uninhabitable by natural disaster, fire, flood, burglary

- Destination uninhabitable or unreachable by fire, flood, or natural disaster

- Revocation of military leave

- Subpoena or being called to serve jury duty

- Hurricanes

- Documented theft of passports or visas

- Employer-initiated transfer of 250 miles or more

- Mechanical breakdown of a common carrier

- Terrorism

- Default or bankruptcy of the common carrier or travel supplier

- Strikes

- Hijacking or quarantining

Trip Interruption

A Trip Interruption is a situation during your trip that causes you to miss some or the rest of your vacation. It’s like Trip Cancellation but happens during your travels.

The most common trip interruption is the injury or illness of a traveler. If you had an injury or illness on your vacation but can continue traveling after treatment, trip interruption reimburses the unused portion of the trip, and the cost to rejoin the trip in progress.

Trip interruption also includes a family member who had a sudden grave illness or passed away. If your covered situation requires curtailing the trip and going home early, Trip Interruption also reimburses for the unused portion of the trip, plus the added cost of going home early.

Both the Island Windjammer policies as well as the AIG Travel Guard Plus policies provide a 150% refund of trip costs.

Cancel For Any Reason

Cancel For Any Reason cruise insurance provides the highest level of flexibility and reimbursement if you must cancel your trip for any reason not covered by the policy.

If you cancel your Island Windjammer cruise for a reason not listed in their travel policy, there is no refund available.

Travel insurance policies like the AIG Travel Guard Plus (CFAR 50%) pay a 50% cash refund of all prepaid, non-refundable trip costs including arrangements made outside of Island Windjammer. This could include hotels, excursions, and transfers. Some other CFAR policies such as the Trawick First Class (CFAR 75%) will provide a 75% refund of all pre-paid, non-refundable trip costs. It’s definitely worth considering one of these policies.

Cancel For Any Reason policies have several stipulations:

- Purchase the policy within 10 - 21 days (depending on policy), of your initial payment or deposit date and

- Insure 100% of the prepaid trip costs subject to cancellation penalties or restrictions. For additional prepaid non-refundable payments made after the purchase of the policy, insure within 10-21 days (depending on policy), of each subsequent payment added to your trip, and

- Cancel your trip 2 days or more before your scheduled departure date.

Medical Insurance for Emergency Treatment

One of the most important factors in selecting trip insurance is having adequate Medical Insurance when you travel. Anything can happen, including accidental injuries or sudden illness.

If you have a medical emergency when traveling and don’t have proper medical insurance coverage while overseas, you could find yourself with huge, unexpected hospital bills. Many Americans mistakenly believe countries with universal health care will treat them for free. Unfortunately, this is not the case.

Instead, Americans receive treatment at private hospitals, not public, and must pay like anyone else. Admission for inpatient care can cost $3,000-$4,000 per day, plus the cost of treatment, x-rays, surgeries, and specialists.

A common misconception is that Medicare will pay for hospitalization overseas. Unfortunately, they won’t. Medicare does not pay providers outside the US. Some Medicare supplements do cover overseas, but have lifetime limits or reduced benefits, and pay for emergencies only. They can still require you to pay 20% of the costs. As a result, you could go on vacation and end up with medical bills in the thousands.

TripInsure101 urges overseas travelers to take travel medical insurance of at least $100,000 per person. In a medical emergency, $100,000 provides ample health care and helps protect your retirement savings from unexpected financial burdens.

The Island Windjammer Asset Plan only provides a $50,000 benefit for Medical Insurance, which is a bit too low for international travel. However, the Bridge Plan provides $100,000 for medical coverage which is our minimum recommendation. The AIG Travel Guard Plus and the Travel Guard Plus (CFAR 50%) also provide $100,000 of medical coverage, so you can receive proper treatment without ending up in debt.

Emergency Medical Evacuation

Medical Insurance isn’t the only potentially expensive part of a trip. Emergency Medical Evacuation transports you from the place of injury or illness to the closest hospital. Once you’re stable enough for transport, Medical Evacuation brings you home via commercial flight or, if necessary, private medical jet.

Medical flights can cost up to $25,000 per hour and regular health insurance does not cover it. In addition, the US State Department does not offer any medical treatment or evacuation assistance for US citizens. AARDY advises travelers to get at least $250,000 Medical Evacuation to assure there’s enough coverage to get them back home from almost anywhere if they experience a serious medical event. However, if traveling to Asia or Africa or beyond, we recommend a minimum of $500,000 for Emergency Medical Evacuation due to the distance from the US.

The Island Windjammer Plans include Medical Evacuation up to $500,000 per person, which is excellent coverage and above our recommendation. The AIG Travel Guard Plus policies provide $1 million per person for Medical Evacuation, so you can feel secure knowing you have adequate coverage to transport you back home if needed.

Pre-existing Medical Conditions

A significant concern for senior travelers can be pre-existing medical conditions. A Pre-Existing Medical Condition is one in which you’ve received medical treatment, testing, medication changes, added new medications, or received a recommendation for a treatment or test that hasn’t happened yet. Most travel insurance policies exclude pre-existing conditions unless you purchase the policy within the required time period from your initial trip deposit date (called the Time Sensitive Period). Otherwise, the insurer will look backward 60, 90, or 180 days (depending on the policy) from the date you purchased the insurance to see if there are any pre-existing medical conditions they won’t cover. This is called the Look Back Period. Any medical conditions older than this Look Back Period, unchanged or stabilized with no medication dosage changes are covered, as are any new conditions that arise after you purchase the policy.

If you must cancel, interrupt, or seek medical treatment for a medical condition while traveling, travel insurance policies typically exclude claims related to Pre-existing Medical Conditions. However, if you purchase the policy within a few days of your Initial Trip Payment or Deposit date, many policies add a Waiver to the policy that covers Pre-existing Conditions. As a result, there is no Look Back Period and Pre-existing Conditions are covered.

The Island Windjammer Plans cover Pre-Existing Conditions as long as the policy is purchased within 15 days of the initial trip payment or deposit. The AIG Travel Guard policies will also provide a waiver to cover Pre-Existing Conditions as long as the policy is purchased within 21 days of the initial trip payment or deposit.

Price and Value

The Island Windjammer Asset Plan offers lower than recommended medical coverage. The medical insurance coverage is only $50,000, which may not be adequate for a serious illness or injury. The Bridge Plan offers $100,000 for medical coverage, which is our recommended minimum amount of coverage. We were pleased to see both plans offer a Pre-Existing Condition Exclusion Waiver and robust cancellation reasons for a reasonable price. While better than many other cruise insurances, we were disappointed that neither plan offered a Cancel For Any Reason option.

In contrast, by comparison shopping, we found the AIG Travel Guard Policies offer superior medical evacuation coverage and a longer time to purchase the policy to receive coverage for Pre-Existing Medical Conditions. The AIG Travel Guard Plus (CFAR 50%) will also provide a 50% refund when cancelling for reasons NOT listed in the policy. Though slightly more expensive than the Island Windjammer policies, the AIG Travel Guard Plus policies provide overall better coverage and options such as Cancel For Any Reason that are not available on either Island Windjammer policies.

Conclusion

The Island Windjammer Plans provide good coverage in most areas at a good price. Overall, we rate it an 8 out of 10.

Travelers planning an Island Windjammer cruise vacation will find the best value for their money and peace of mind when they shop for travel insurance at TripInsure101 Travel Insurance Marketplace. There, you can review dozens of options and select the best policy to fit your needs.

To help you find the best policy, TripInsure101 recommends having at least $100,000 in travel medical coverage and $250,000 emergency medical evacuation when traveling outside the US. And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with the pre-existing condition waiver included to ensure the most coverage for your money.

If you are planning an Island Windjammer cruise in 2022, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at agent@TripInsure101.com or alternatively call us at +1(650) 397-6592. We would love to hear from you.

Safe Travels

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

clancygirl

Thank you very much! …

The person I spoke with was very nice and helpful. I was very happy to discover the my trip insurance was going to cost less than I expected. Thank you!

customer

Quick easy and met my financial goal

Quick easy and met my financial goal

Carol

Quick, easy and economical

Melanie was very knowlegeable about all the policies and very helpful in finding the right policy for use. We are extremely happy with the results. She mad the process so easy and easy to understand. We will do business with you the next time we need travel insurance. Thank you.