SeaDream Yacht Club Travel Insurance - 2025 Review

SeaDream Yacht Club Travel Insurance - Review

7

Strengths

- Reputable Insurer

- Option For Cancel For Any Reason

- Good Medical Evacuation Insurance

Weaknesses

- Cancel For Any Reason Is Expensive

- Classic Plus Has Low Medical Insurance Coverage

- Cannot purchase at checkout

Sharing is caring!

Introduction

SeaDream Yacht Club caters to small ship experiences on mega-yachts. Currently, they sail the Mediterranean in summer and the Caribbean in winter.

SeaDream cruise insurance offers two options: Classic Plus and Premier. They provide an option to add Cancel For Any Reason for a 50-55% cost increase. Although you can book a cruise online, you must call SeaDream to enroll in insurance.

Starr Indemnity and Liability Corporation underwrites SeaDream cruise travel insurance. They are a reputable underwriter that also backs the John Hancock travel insurance policies at TripInsure101.

Our Cruise: Barcelona to Civitavecchia (Rome)

In this review, we picked the 7-day Barcelona to Civitavecchia (Rome) cruise from May 8, 2022 – May 15, 2022, to illustrate travel insurance comparisons. The total cost for two senior travelers, ages 55 and 60, is $10,852.

SeaDream does not sell its own insurance. Instead, they recommend you purchase travel insurance from a third-party vendor. They do provide a link to purchase travel insurance from Starr Assist, a travel insurance partner.

Comparison Quotes

Whenever you look at the insurance a cruise line recommends, be sure to compare it to other options available in the wider marketplace. This way, you’re able to see if what the cruise line offers is good value and a good fit for your travel needs.

TripInsure101 recommends all travelers venturing abroad have sufficient insurance in case of an overseas catastrophe. This saves you the heartache of paying for medical treatment out of pocket or a possible 6-figure transportation fee to return home in a worst-case scenario.

TripInsure101 consistently recommends carrying at least $100k Medical Insurance, $250k Medical Evacuation, and a Pre-Existing Medical Condition Waiver when traveling outside the US.

We used the same trip information to create a quote at TripInsure101 to compare with our SeaDream insurance option from Starr Indemnity. Our system provided 25 quotes for comprehensive travel policies from various insurers.

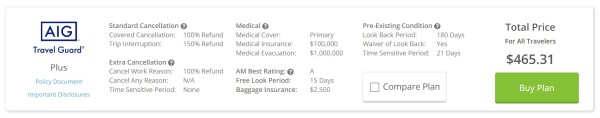

For this trip, the AIG Travel Guard Plus plan is the least expensive policy that meets the recommended coverage amounts, for a total of $456.31 for both travelers. The AIG plan also provides $100,000 per person of medical coverage and $1 million of medical evacuation coverage, as well as coverage for pre-existing medical conditions if the plan is purchased within 21 days of the initial trip deposit or payment date.

For a Cancel For Any Reason policy, the least expensive plan on our quote that has adequate coverage for the trip is the Trawick First Class (CFAR 75%). This policy provides $150,000 of medical coverage, $1 million of medical evacuation coverage as well as coverage for pre-existing medical conditions if the plan is purchased within 14 days of the initial trip deposit or payment date. Should you cancel for a reason NOT listed in the policy, it will pay up to 75% of your trip cost back in the form of a cash refund.

Unfortunately, neither Starr Assist plan includes Cancel For Any Reason as a standard feature. Instead, you add it at purchase and pay an additional 50-55% premium.

In this comparison, we show you the prices with and without Cancel For Any Reason included on both SeaDream plans.

|

Benefit |

Sea Dream Classic Plus |

Sea Dream Premier |

AIG Travel Guard Plus |

Trawick First Class (CFAR 75%) |

|

Trip Cancellation |

100% of trip cost |

100% of trip cost |

100% of trip cost |

100% of trip cost |

|

Trip Interruption |

150% of trip cost |

150% of trip cost |

150% of trip cost |

150% of trip cost |

|

Medical Insurance |

$50,000 |

$250,000 |

$100,000 |

$150,000 |

|

Medical Evacuation |

$500,000 |

$500,000 |

$1,000,000 |

$1,000,000 |

|

Baggage Loss/Damage |

$1,000 |

$2,500 |

$2,500 per person |

$2,000 per person |

|

Baggage Delay |

$300 |

$500 |

$400 |

$400 |

|

Travel Delay |

$750 ($250/day) |

$2,000 ($500/day) |

$1000 ($200/day) |

$1,000 |

|

Missed Connection |

$750 |

$750 |

$1,000 per person |

$1,000 per person |

|

Cover Pre-existing Medical Conditions |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 14 days of deposit |

Yes, if purchased within 21 days of deposit |

Yes, if purchased within 14 days of deposit |

|

Cancel For Work Reason |

No |

No |

No |

No |

|

Cancel For Any Reason

|

Optional |

Optional |

No |

Yes |

|

Accidental Death & Dismemberment |

$10,00 Anytime |

$50,000 Anytime $200,000 Air Only |

$50,000 |

$10,000 Anytime $25,000 Air Only |

|

Cost of Policy |

$637.00 (5.9% of trip cost)

|

$896 (8.3% of trip cost) |

$465.31 (4.3% of trip cost) |

$1,052.64 (9.7% of trip cost) |

|

Cost of Policy with Cancel For Any Reason |

$955.50 (8.8% of trip cost) |

$1,388.80 (12.8% of trip cost) |

N/A |

$1,052.64 (9.7% of trip cost) |

Price and Value

When comparing all four policies we notice several things that would make us rethink buying insurance through SeaDream:

First, both SeaDream policies cost an additional $300 - $400 more to add Cancel For Any Reason. However, the Trawick First Class with Cancel For Any Reason built-in costs less than $1,060.

Second, SeaDream Classic Plus’s costs more than AIG Travel Guard Plus but provides less Medical Insurance.

Third, while the SeaDream Premier is a robust policy, but we think the price is too high for what you get. In this case, Premier’s benefit levels closely resemble Travel SE but costs $300 more than the Trawick policy.

Overall, you get far more value from the TripInsure101 policies for your money.

In general, when you look for travel insurance through a marketplace like TripInsure101, you’ll find more coverage for the money.

Trip Cancellation

Both of SeaDream’s travel insurance policies include a 100% refund for cancellation due to:

- Injury, sickness or death of you, your traveling companion, your family member, your children’s caregiver, or your business partner that results in medically imposed restrictions

- Inclement weather, natural disasters, terrorist attacks or mechanical breakdown of the common carrier

- Mandatory evacuation ordered by local authorities at your destination due to a natural disaster.

- Natural Disaster that renders your primary residence or the accommodations at your destination uninhabitable.

- Adverse weather or natural disaster resulting in the obstruction of public roadways or curtailment of public transportation that prevents your ability to arrive at your land/sea arrangements.

- A road closure causing a delay in reaching your destination for at least 12 hours.

- Strike that causes complete cessation of travel services of your common carrier for at least 48 consecutive hours.

- Bankruptcy and/or default of your travel supplier that occurs more than 14 days following the effective date of your scheduled departure date must be no more than 12 months beyond the effective date.

- A documented security breach in the airport terminal within 12 hours of arrival or while you are physically at the terminal.

- A politically motivated terrorist attack that occurs within 30 days of your departure and within 50 miles of a city listed on your itinerary.

- A documented theft of passports or visas.

- You or your traveling companion directly involved in or delayed due to a traffic accident substantiated by a police report, while en route to departure.

- You and/or your traveling companion are hijacked, quarantined, required to serve on a jury, subpoenaed, required to appear as a witness in a legal action, provided you or your traveling companion are not a party to the legal action or appearing as a law enforcement officer.

- You and/or your traveling companion are victims of felonious assault, having your principal place of residence made inaccessible and uninhabitable by a natural disaster, or burglary or vandalism of your principal place of residence within 10 days of departure.

We’re pleased to see such a robust list of cancellation reasons.

Trip Interruption

Both SeaDream cruise insurance programs also contain Trip Interruption benefits. So, if your husband had a stroke during the trip and you had to leave immediately, Trip Interruption coverage reimburses the cost of returning home early. It also refunds you for the unused part of the trip.

Plus, Trip Interruption compensates you if something delays the start of your trip. For example, a winter storm shut down the airport and delayed your flight to the port. Your policy refunds you for the missed days and new travel arrangements to reach the destination.

SeaDream cruise insurance uses the same list of covered cancellation reasons for Trip Interruption. The AIG Travel Guard Plus and the Trawick First Class (CFAR 75%) policies work the same way.

Cancel For Any Reason

Cancel For Any Reason cruise insurance provides the highest level of flexibility and reimbursement if you must cancel your trip for any reason not covered by the policy.

If you add the Cancel For Any Reason option to the SeaDream Classic Plus or Premier policies you can cancel your SeaDream cruise for a reason not listed in their travel policy and receive a 75% refund in cash. Surprisingly, they do refund in cash instead of cruise credits like other cruise lines. When it comes to refunds, we always prefer cash since future credits may not be used.

Travel insurance policies like the Trawick First Class (CFAR 75%) also pay a 75% cash refund of all prepaid, non-refundable trip costs including arrangements made outside of SeaDream. This could include hotels, excursions, and transfers.

Cancel For Any Reason policies have several stipulations:

- Purchase the policy within 10 - 21 days (depending on policy), of your initial payment or deposit date and

- Insure 100% of the prepaid trip costs subject to cancellation penalties or restrictions. For additional prepaid non-refundable payments made after the purchase of the policy, insure within 10-21 days (depending on policy), of each subsequent payment added to your trip, and

- Cancel your trip 2 days or more before your scheduled departure date.

Medical Insurance

One of the most important factors in selecting trip insurance is having adequate Medical Insurance when you travel. Anything can happen, including accidental injuries or sudden illness.

If you have a medical emergency when traveling and don’t have proper medical insurance coverage while overseas, you could find yourself with huge, unexpected hospital bills. Many Americans mistakenly believe countries with universal health care will treat them for free. Unfortunately, this is not the case.

Instead, Americans receive treatment at private hospitals, not public, and must pay like anyone else. Admission for inpatient care can cost $3,000-$4,000 per day, plus the cost of treatment, x-rays, surgeries, and specialists.

A common misconception is that Medicare will pay for hospitalization overseas. Unfortunately, they won’t. Medicare does not pay providers outside the US. Some Medicare supplements do cover overseas, but have lifetime limits or reduced benefits, and pay for emergencies only. They can still require you to pay 20% of the costs. As a result, you could go on vacation and end up with medical bills in the thousands.

Sadly, travelers also assume their private health insurance will pay for all of their medical needs while traveling. Within the US, this may be true, but once you leave the US border, you’re financially exposed.

If you need medical treatment overseas, you must pay out-of-pocket for costly services. Even in countries with nationalized medicine, they rarely extend coverage to people who are not citizens. Indeed, Americans receive treatment at private hospitals, not public hospitals, so they bill you the full cost.

Likewise, the US State Department and the CDC urge travelers to take robust Medical Insurance when traveling outside the US. Few people realize that government organizations like Medicare and the State Department deny payment for Americans’ health care overseas.

Even if you have a private Medicare supplement, the coverage is limited. Some supplements provide for $50,000 of emergency medical treatment. However, it’s a lifetime limit, and you must pay 20% of that amount. Even with a $40,000 bill, Medicare makes you pay $8,000 in cash. For treatment costs over $50,000, Medicare requires you to pay the rest of it yourself.

That’s why TripInsure101 recommends each traveler take at least $100,000 Medical Insurance when leaving the US. If you travel with less than $100,000 Medical Insurance, your retirement savings could vaporize paying for medical treatment in a foreign country.

Regrettably, SeaDream’s Classic Plus cruise travel insurance only provides $50,000 of medical insurance. Both the AIG Travel Guard Plus and the Trawick First Class provide $100,000 and $150,000 of Medical Coverage respectively.

On the other hand, SeaDream Premier trip insurance includes a $250,000 Medical Insurance benefit. We are delighted to see this amount. It's significantly higher than what we recommend and covers virtually any medical emergency.

Emergency Medical Evacuation

Medical Insurance isn’t the only potentially expensive part of a trip. Emergency Medical Evacuation transports you from the place of injury or illness to the closest hospital. Once you’re stable enough for transport, Medical Evacuation brings you home via commercial flight or, if necessary, private medical jet.

Medical flights can cost up to $25,000 per hour and regular health insurance does not cover it. In addition, the US State Department does not offer any medical treatment or evacuation assistance for US citizens. TripInsure101 advises travelers to get at least $250,000 Medical Evacuation to assure there’s enough coverage to get them back home in the event of a serious medical issue. For trips further afield to Asia or Antarctica, we recommend at least $500,000 of medical evacuation due to the distance from the United States.

Both SeaDream policies provide $500,000 of Medical Evacuation while both the AIG Travel Guard Plus and the Trawick First Class plans provides $1,000,000 for Medical Evacuation, so you can feel secure knowing you have adequate coverage to transport you back home if needed, no matter how far from home you’ve traveled.

Pre-existing Medical Conditions

A significant concern for senior travelers can be pre-existing medical conditions. A Pre-Existing Medical Condition is one in which you’ve received medical treatment, testing, medication changes, added new medications, or received a recommendation for a treatment or test that hasn’t happened yet. Most travel insurance policies exclude pre-existing conditions unless you purchase the policy within the required time period from your initial trip deposit date (called the Time Sensitive Period). Otherwise, the insurer will look backward 60, 90, or 180 days (depending on the policy) from the date you purchased the insurance to see if there are any pre-existing medical conditions they won’t cover. This is called the Look Back Period. Any medical conditions older than this Look Back Period, unchanged or stabilized with no medication dosage changes are covered, as are any new conditions that arise after you purchase the policy.

The SeaDream plans cover Pre-Existing Conditions as long as the policy is purchased within 14 days of the initial trip payment or deposit. This is also the case for the Trawick First Class and you have 21 days to purchase the policy to get pre-existing conditions covered with the AIG Travel Guard Plus. Outside of these time periods, the SeaDream plans and AIG will look back 180 days while the Trawick policy only looks back 60 days to see if you have any pre-existing medical conditions they won’t cover.

Conclusion

The SeaDream Classic Plus Plan offers lower than expected coverage for the high price. The medical insurance coverage is only $50,000. However, the Premier plan provides $250,000 of medical coverage which we were pleased to see, and both offer $500,000 for medical evacuation, some of the highest in the cruise lines we’ve reviewed. We were also pleased that both plans offer a Pre-Existing Condition Exclusion Waiver, robust cancellation reasons and cash refunds when the Cancel For Any Reason option is added. While better than many other cruise insurances, the price for this coverage is high.

However, the Cancel For Any Reason add-on brings the price of the policy up so high that it’s less expensive to get a policy with Cancel For Any Reason built-in, such as the Trawick First Class (CFAR 75%).

In conclusion, the SeaDream policies are quality comprehensive travel insurance plans. Although Classic Plus’ Medical Insurance falls short of our recommendation by 50%, we would recommend the Premier plan. Overall, we rate them a 7 out of 10.

Travelers planning a SeaDream Yacht Club cruise vacation will find the best value for their money and peace of mind when they shop for travel insurance at TripInsure101 Travel Insurance Marketplace. There, you can review dozens of options and select the best policy to fit your needs.

To help you find the best policy, TripInsure101 recommends having at least $100,000 in travel medical coverage and $250,000 emergency medical evacuation when traveling outside the US. And, if you purchase the policy within the 14-21 days of initial trip payment, please consider a travel insurance policy with the pre-existing condition waiver included to ensure the most coverage for your money.

If you are planning an SeaDream cruise in 2022, be sure to pack insurance before you travel. You never know when you may need it.

Have questions? Chat with us online, send us an email at agent@TripInsure101.com or alternatively call us at +1(650) 397-6592. We would love to hear from you.

Safe Travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

clancygirl

Thank you very much! …

The person I spoke with was very nice and helpful. I was very happy to discover the my trip insurance was going to cost less than I expected. Thank you!

customer

Quick easy and met my financial goal

Quick easy and met my financial goal

Carol

Quick, easy and economical

Melanie was very knowlegeable about all the policies and very helpful in finding the right policy for use. We are extremely happy with the results. She mad the process so easy and easy to understand. We will do business with you the next time we need travel insurance. Thank you.