Seven Corners Get Away USA Trip Insurance - 2025 Review

Seven Corners Get Away USA Trip Insurance

8

Strengths

- Strong Insurance Partner

- Good Trip Cancellation Benefit

Weaknesses

- No Waiver for Pre-Existing Conditions

- Must Add Bundles for Medical and Baggage

Sharing is caring!

Seven Corners Travel Insurance: What is Get Away USA Travel Insurance?

The Get Away USA is a customizable policy from Seven Corners Travel Insurance for US residents for domestic travel only. It provides coverage for trip cancellation and trip interruption but allows the traveler to customize the plan by adding bundles for medical coverage, baggage coverage, rental car coverage or cancel for any reason benefits for trips up to 90 days.

Note: this policy is NOT available in NY, WA, PA, MO.

Get Away USA Travel Insurance Benefits

The policy is intended for domestic travelers primarily wanting only trip cancellation or those preferring to tailor their policy to specific needs in an a-la-carte format.

The base policy covers:

100% of trip cost up to a maximum of $20,000

Trip Interruption - 125% of your non-refundable trip cost

Trip cancellation coverage provides reimbursement for 100% of the trip cost, up to $20,000. Trip interruption also provides up to 125% of the trip cost if you must cut the trip short due to a covered reason.

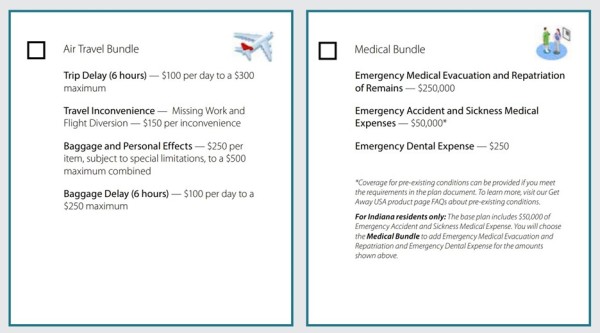

Several bundles are available as add-ons if additional coverage is needed for medical and medical evacuation or baggage or coverage for air travel concerns.

The Air Travel Bundle provides $100/day per traveler for meals and hotel costs up to the maximum of $300 for trip delays of six (6) hours or more, while baggage coverage is set at $250 per item up to a $500 maximum.

Travel Inconvenience will pay $150 if the traveler has a flight diversion or misses work due to travel issues. Baggage coverage is included in the bundle up to $250/item to a maximum of $500 total and Baggage Delay will reimburse $100/day up to $250 if baggage is delayed for six (6) or more hours.

The Medical Bundle will provide emergency accident and sickness expense coverage up to $50,000 (including $250 for repair to a dental injury) and up to $250,000 in emergency medical evacuation or repatriation of remains. Pre-existing medical conditions can be covered if the policy is purchased within twenty (20) days of the initial trip payment or deposit.

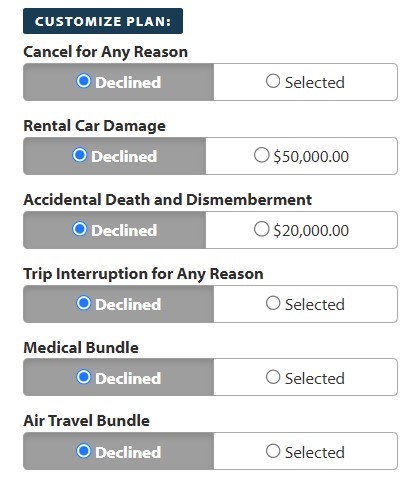

In addition to the above bundles, several optional benefits can be selected:

Cancel for Any Reason will refund 75% of the trip cost as will Interrupt for Any Reason. To be eligible for Cancel for Any Reason and/or Interrupt for Any Reason, the policy must be purchased within twenty (20) days of the initial trip payment or deposit date.

Rental car damage coverage, including RV rentals, of up to $50,000 can be included and Accidental Death & Dismemberment (AD&D) of $20,000 can be added as well.

To add these optional benefits simply select them during the policy purchase process:

For each customizable benefit, select the ones to be added to the base policy when purchasing.

Once added, the premium will be recalculated with the additional benefits before purchase is completed.

Get Away USA Policy Benefits

Trip Cancellation - 100% of Trip Cost up to $20,000

Covers your non-refundable, prepaid trip cost if you are unable to take your trip due to a covered reason.

Trip Interruption - Up to 125% of Trip Cost

Covers the non-refundable, unused portion of your prepaid trip cost and the additional cost to return home or rejoin your trip due to a covered reason.

Optional Coverages

Travel Bundle

Trip Delay - $100 up to $300

Pays for additional transportation, meals, accommodations, and non-refundable, unused prepaid expenses if you are delayed six (6) or more hours en route to/from your trip.

Travel Inconvenience - $150 per inconvenience

Missing Work: If you miss work due a delay in your return of two (2) days or more due to a Common Carrier-caused delay. Documentation of the requirement to work will be needed.

Flight Diversion: If your Common Carrier flight arrives at a different airport than the originally ticketed destination.

The Travel Inconvenience benefit cannot be combined with other benefits such as Trip Cancellation, Trip Interruption, Trip Delay, Baggage Delay, or Emergency Evacuation benefits when filing a claim.

Medical Protection

Emergency Medical Expense - $50,000 (Includes Dental Expense of $250 for an injury)

Covers medical treatment for a sickness or injury that occurs during your trip.

Emergency Medical Evacuation/Repatriation - $250,000

Transportation to the nearest appropriate medical facility if medically necessary and return your remains to your residence or burial place if you die while traveling. If you are hospitalized more than seven (7) days, we will 1) transport dependent children home if they are traveling with you, and 2) send a person chosen by you to/from your bedside if you are traveling alone.

Baggage Protection

Lost, Stolen or Damaged Baggage & Personal Effects - $250/item up to $500

Baggage Delay - $100/day up to $250

Covers checked bags for flights on the way TO destinations if delayed or misdirected by a Common Carrier for at least six (6) hours from your arrival time at your destination other than your Return Destination.

Non-Insurance Services

24/7 Travel Assistance Service - Included (provided by Seven Corners Assist)

Optional Benefits

Rental Car Damage - $50,000

Provides rental car damage coverage while on your trip.

Cancel For Any Reason - 75% of Trip Cost refunded

Pays if you cancel your trip for any reason not otherwise covered, if 1) you cancel two days or more before departure, 2) you buy coverage within 20 days of your initial trip deposit, and 3) you insure all nonrefundable prepaid trip costs (you must also insure the cost of subsequent travel arrangements added to your trip within 15 days of the payment/deposit for each of those arrangements.)

Interrupt For Any Reason - 75% of Trip Cost refunded

Pays if your trip is interrupted 48 hours or more after departure for any reason not otherwise covered, if you buy coverage within 20 days of your initial trip deposit.

Trip Cancellation And Interruption Covered Reasons

- Sickness, Injury or Death

- Complications from Pregnancy

- Jury Duty

- Quarantine

- Court-Ordered Appearance

- Traffic Accident

- Residence Uninhabitable

- Strike

- Felonious Assault

- Military Duty for Natural Disaster Relief

- Termination/Layoff/Transfer

- Weather

- Terrorist Incident

- Bankruptcy/Default

- Natural Disaster

- Hijacking

Conclusion

We think that the Seven Corners Get Away USA Travel Insurance plan strikes a good balance between coverage for travelers only needing trip cancellation benefits for domestic travel and those who prefer to tailor their policy to their specific requirements.

Safe travels!

This article has been written for review purposes only and does not suggest sponsorship or endorsement of AARDY by the trademark owner.

Recent AARDY Travel Insurance Customer Reviews

clancygirl

Thank you very much! …

The person I spoke with was very nice and helpful. I was very happy to discover the my trip insurance was going to cost less than I expected. Thank you!

customer

Quick easy and met my financial goal

Quick easy and met my financial goal

Carol

Quick, easy and economical

Melanie was very knowlegeable about all the policies and very helpful in finding the right policy for use. We are extremely happy with the results. She mad the process so easy and easy to understand. We will do business with you the next time we need travel insurance. Thank you.